Homeownership is one of the most significant investments many people make, and over time, that investment can grow in value. One of the best ways to tap into this value is through home equity. But what exactly can you do with home equity? From home improvements to consolidating debt, the possibilities are endless. In this guide, we'll explore various ways you can leverage your home equity to meet your financial goals.

Read MoreAre you a homeowner looking for ways to leverage the value of your property? Understanding home equity (sometimes called a second mortgage) is key to unlocking financial opportunities. Whether you're considering home improvements, consolidating debt, or planning for retirement, knowing how to tap into your home equity can be a game-changer. In this post, we'll break down what home equity is, how to calculate it, and how you can use it wisely.

Read MoreWhen it comes to your credit score, understanding the difference between hard and soft inquiries will give you more control over your finances. Learn the key differences between hard and soft inquiries, how they affect your credit score, when they are used, and tips to manage them responsibly.

Read MoreFinancing a car is a big decision, and making the wrong move can cost you in the long run. At Service One Credit Union (SOCU), we want to help you make informed financial choices so you can drive away with confidence. Here are some common car loan mistakes and how to avoid them.

Read MoreIf you own a home and have built up some equity, you might have heard about Home Equity loans and Home Equity Lines of Credit (HELOCs). But what do they mean, and how are they different? Let’s break it down in a way that’s easy to understand.

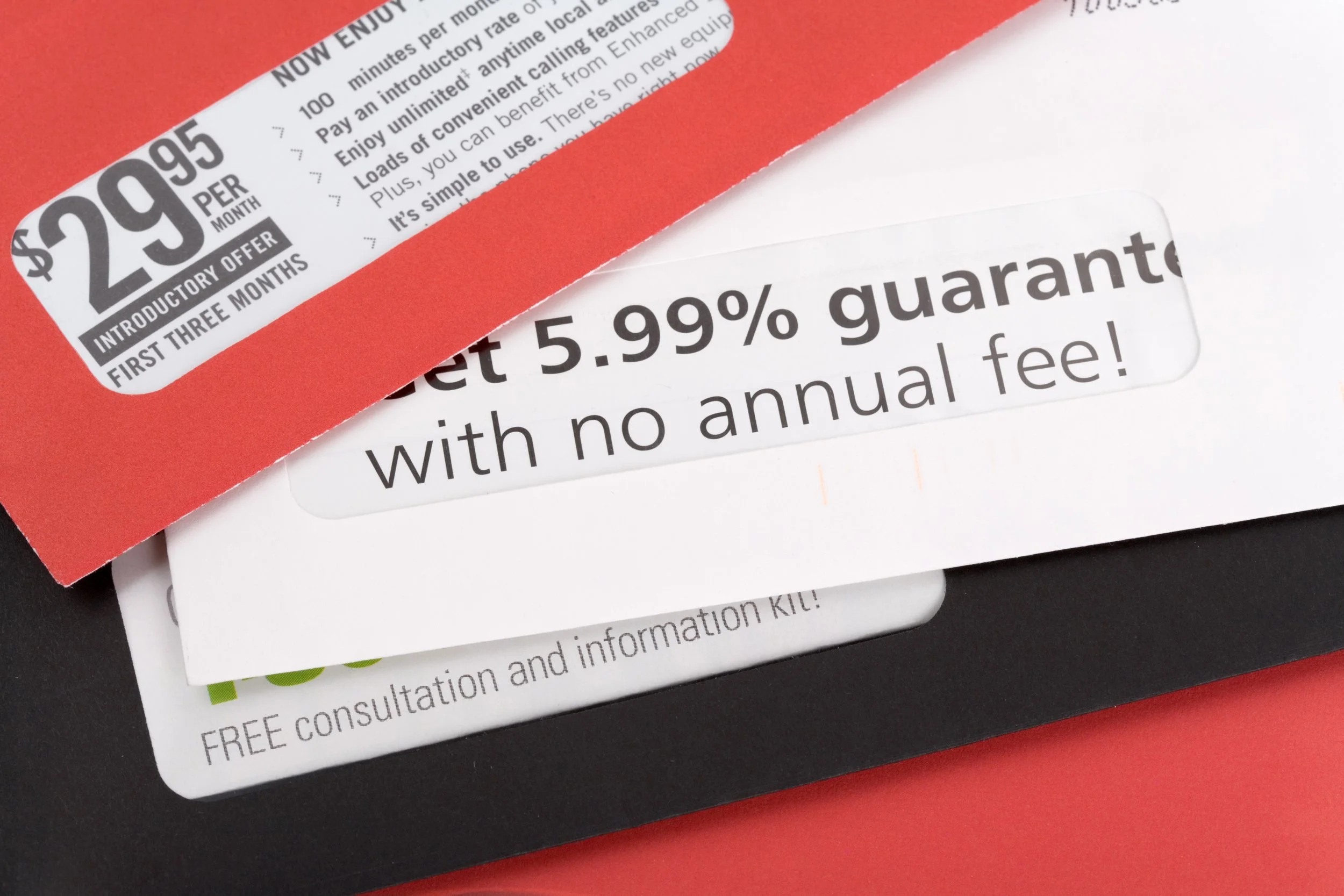

Read MoreHave you ever wondered why you receive so much junk mail? Or maybe you’re not sure if a piece of mail is a scam? Read this blog post to better understand what “Credit Triggers” are and how you can take control of your information and stop the junk mail.

Read MoreOur Holiday Helper Loan is now available through Dec 15, 2023. A great alternative to high rate interest credit cards.

Read More