It feels like you just packed away the holiday decorations yesterday, but believe it or not, 2024 is already half over. As we sail into the season of barbecues and beaches, take a few minutes to give yourself a mid-year financial checkup. A small investment of time can spur important changes that can affect your financial wellness for the rest of 2024 or even for years to come.

Read MoreWhile it’s great to get away for some fun in the sun, it’s important to stick to a budget, even when on vacation. An over-the-top vacay you can’t afford can mean spending months catching up on credit card payments and paying high-interest rates that may make it not worth the price. This year, attack your vacation with a financial plan that you can keep by following the tips outlined below.

Read MoreThe best way to teach a child financial responsibility is by encouraging them to earn and manage money on their own. As the weather warms and summer nears, there are many opportunities for your kids to pull in some extra money.

Read MoreIf you’re always wondering how you’re going to pay the next bill, feel guilty when you indulge in overpriced treats and you can’t seem to find money to put into savings, then you probably need a budget.

Read MoreEveryone knows how important it is to regularly put money into savings, but research shows that 25% of Americans have no emergency savings at all.

Don’t let this be you! If you’re ready to start saving, but you don’t know where to begin, Service One Credit Union can help. Here are seven simple steps that can get you on the fast track to building your nest egg today

Read MoreIf you’re like most people, you likely start each year with a list of resolutions to help you improve various aspects of your life. The list may include resolutions to help you become more physically fit, further your career growth and improve your personal relationships. Another category of resolutions you may make centers on those that affect your finances.

Read MoreThe 12 days of Christmas are filled with joyous gift giving. But forget about buying five golden rings, four calling birds and three French hens. Put more money in your pocket by following these year-end suggestions.

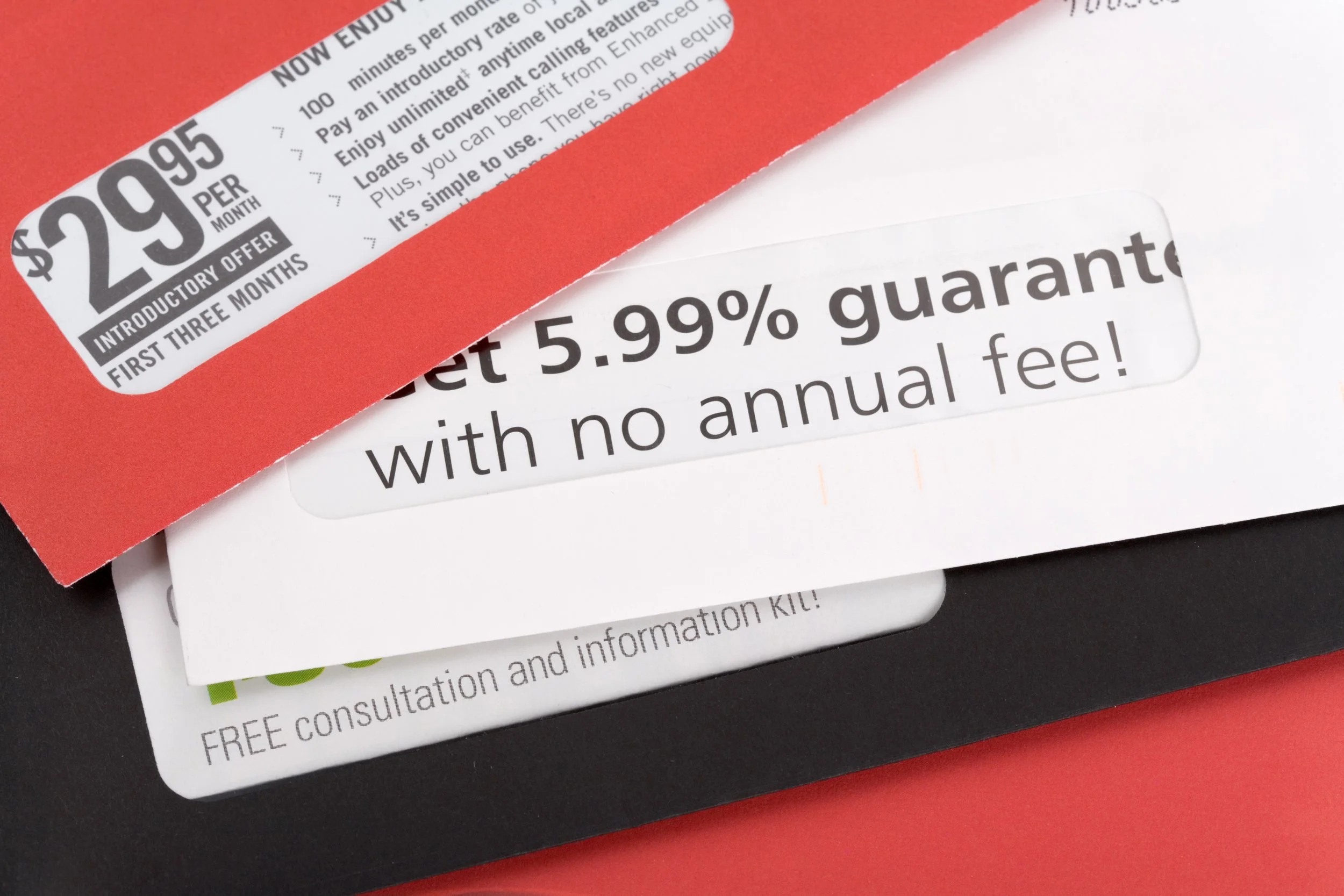

Read MoreHave you ever wondered why you receive so much junk mail? Or maybe you’re not sure if a piece of mail is a scam? Read this blog post to better understand what “Credit Triggers” are and how you can take control of your information and stop the junk mail.

Read MoreBetween your turkey, ingredients for the holiday meal, and décor to set the ambiance, hosting a Thanksgiving dinner is not cheap.

If you’re looking for ways to cut back without compromising on quality, here are seven easy ways to save on Thanksgiving costs this year.

Read MoreOur Holiday Helper Loan is now available through Dec 15, 2023. A great alternative to high rate interest credit cards.

Read MoreBOWLING GREEN, KY - Service One Credit Union, a not-for-profit member-owned financial cooperative serving South Central and Western Kentucky, is proud to announce the promotion of Justin Morris to President and Chief Strategy Officer.

Read MoreAre you ready to stretch those financial fitness muscles? We hope so, because it’s time to get financially fit!

Read MoreWhen life is comfortable and things are going well, it’s hard to think about experiencing harder times. But failing to plan for stormier days can have a devastating impact on your financial health.

Read MoreJoin us on September 16th in Bowling Green and Glasgow and September 23rd in Hopkinsville from 9:00 a.m. to 12:00 p.m. for our annual Shred Day!

Read MoreWant to see a glimpse into the future of Service One? Check out the design plans for Service One Credit Union’s branch located near the bypass!

Read MoreService One Credit Union's Prosper Foundation is honored to be the title sponsor of the 2023 Bowling Green International Festival!

Read MoreService One Credit Union is donating $20,000 to the College Heights Foundation at Western Kentucky University (WKU) to provide student scholarships.

Read MoreThe rise of online shopping during the pandemic has led to a proportional increase in online fraud and scams. As the Holiday season approaches, we want to make sure you are armed with the knowledge and the skills to protect yourself.

Read MoreYou are standing in line at the pharmacy, ready to check out. While fumbling around in your purse for cash or a card, you notice the person in front of you has simply scanned their smartphone across the payment card reader.

Read MoreIn today's world, it is more important than ever to focus on the things that we can control to better safeguard our financial future. It's easy to get complacent, lulled into a false sense of security, when there are many other more urgent things to think about.

Read More